Grow your digital dollar: How to market commerce that performs

(First published on WARC)

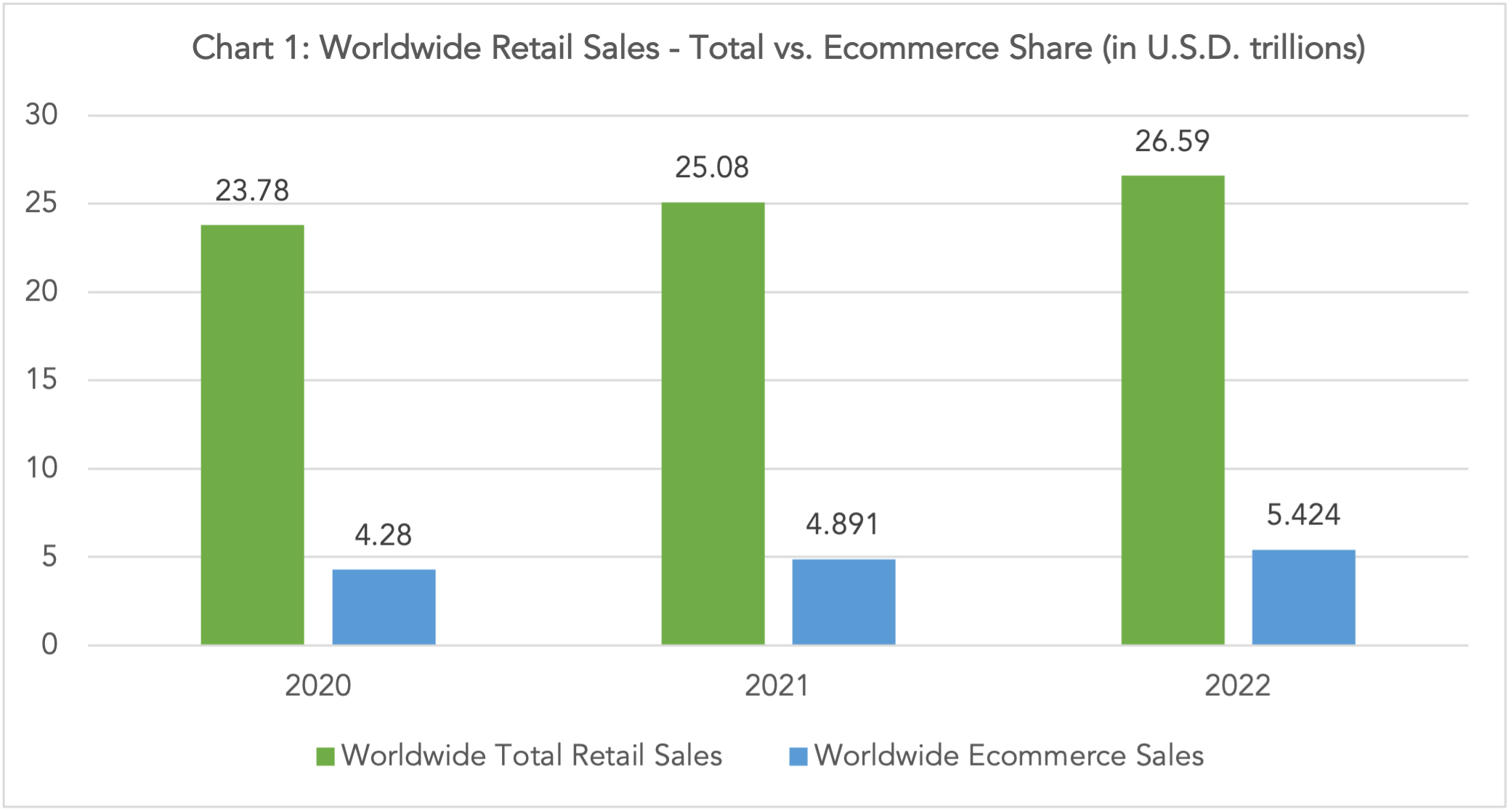

To live their lives, people need to buy things. When you lockdown more than 3.9 billion people and take away the choice of how and where to shop, it shall be of no surprise that they will use alternative ways to buy things – like the Internet. Yes, Coronavirus pandemic moved consumers to shop online and that’s okay. 2020 witnessed more than 2 billion consumers spending $4.28 trillion online, compared to $3.354 trillion in 2019. The future growth may not be as aggressive as 2020, though the online shift created by the pandemic is here to stay. In 2021, Ecommerce is estimated to grab $4.891 trillion of global retail sales, followed by $5.424 trillion in 2022 (Chart 1).

Selling on the Internet is inarguably lucrative for any company – it reduces layers of physical spaces, middlemen, experts, and sales force dramatically. The need of the hour is not to be fascinated by OR cynical about the Ecommerce push brought to us by the Covid-19, but to focus on how to make consumers continue to shop our brands and products online in a post pandemic world. A world where consumers will have a choice between ‘a shopping trip to the supermarket’, and ‘adding to the basket’ on the Internet.

Digital consumer acquisition and retention is a growing priority for marketers across the world. Between 2017 and 2020, global marketers spent $1.2 trillion in online advertising, and in 2021 they are expected to spend $455.3 billion in the medium. With average revenue per Ecommerce user expected to reach $856.81 in 2021 – marketers across the world are in a race to maximise their share of “Digital Dollar”. Performance marketing has become the top priority. According to WARC’s Marketer Toolkit 2021, 51% of their global respondents plan on increasing spends in performance marketing vs. 32% in 2020. With more marketers investing more ad dollars in performance marketing, there’s a need to understand how we can maximise performance return and minimise its wastage.

So, through this piece, let’s try to answer the following three questions:

1. What can performance marketing do for retailers and manufacturers to grow their share of digital dollar?

2. In a non-linear path to purchase, where to invest performance dollars to generate maximum return?

3. What are the metrics that matter to optimise and improve the effectiveness of performance spend against bottom-line impact?

1. Performance for manufacturers and retailers:

Not everything that is bought offline should be sold online. For example, according to U.S. retail census data, the top 5 categories by total retail sales are Automobiles, Electronics, Food & Beverages, General Merchandising, and Restaurants & Drinking Places. Whereas, for online, the top 5 sales categories are Fashion, Toys & DIY, Electronics & Media, Food & Personal Care, and Furniture & Appliances. Success in Ecommerce is all about defining your business portfolio to meet online consumer behaviours at a retail, category, brand, product, and channel level.

To succeed in performance marketing, our job should be to make more consumers buy more of what sells more online, more often. Unlike physical retail, online retail can provide real-time intelligence. Analysis of several performance marketing campaigns in the CPG sector suggests, brands that plan eStore content and off-site/on-site media using real-time intelligence deliver 5X more basket conversion vs. those that don’t. If you are a retailer, take a daily dive into your ‘Ecommerce Intelligence Centre’ to understand your top performing categories, brands, and products – bring them to your eStore front through data-driven real-time personalisation and design your consumer data segmentation, content, offers and media around them. For your low performing inventory, test it at a checkout stage through “basket value auto-recommendation offers”, try unique schemes like “Penny Sale” – OR consider offering free shipping in exchange for a minimum purchase volume, whilst auto-recommending low performing products to help meet the purchase volume.

If you are a manufacturer, start your performance journey by understanding which online retailers are selling more of your inventory and that of your competitor. Once you know your top sellers, invite your sales and cross-functional teams to develop and invest in an “annual performance partnership programme” in return of tangible outcomes – these could include:

· Real-time data exchange partnership

· Increased eStore front visibility

· Increased eStore category visibility

· Increased eStore search visibility

· Cross category personalised recommendations (at a product detail page)

· Increased visibility in eStore media channels (off-site search, push notifications, Emails, video, etc.)

· Increased eStore check-out visibility

2. Investing in performance ad dollars:

One of the key ingredients in running a successful retail business is maximizing footfall. If you can bring more people to your retail destination, more often – the chances are you will make more money, more often. Online retail works on the same fundamental. However, in a complex digital path to purchase, how, and where to invest performance dollars to maximise footfall? To answer this, let’s analyse the path consumers take to reach online retailers. For the purposes of this analysis, let’s look at pureplay and omni-channel retailers from Ecommerce developed (UK) and developing markets (UAE).

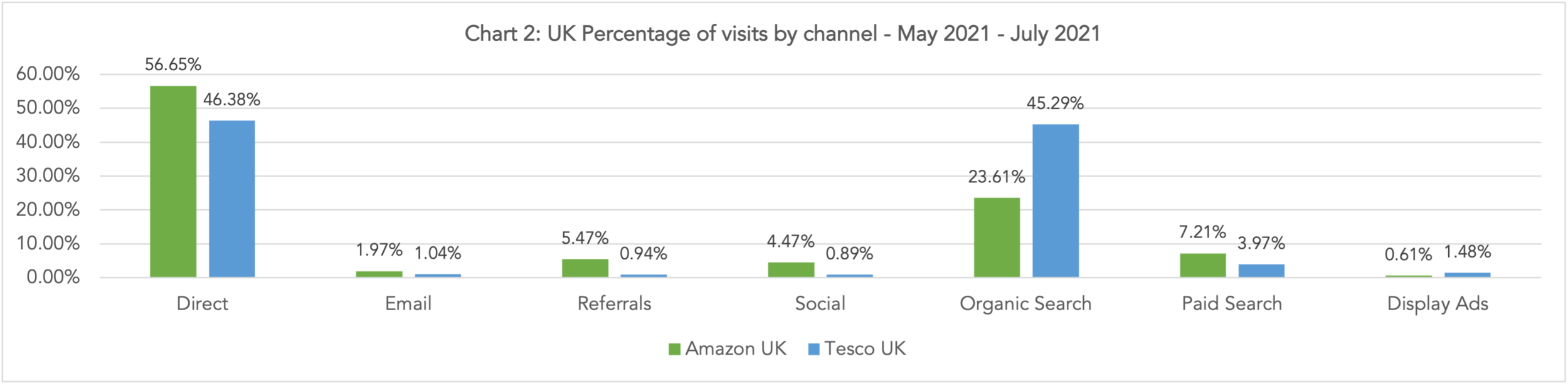

Chart 2 below looks at the percentage of visits by channel for Amazon UK and Tesco UK.

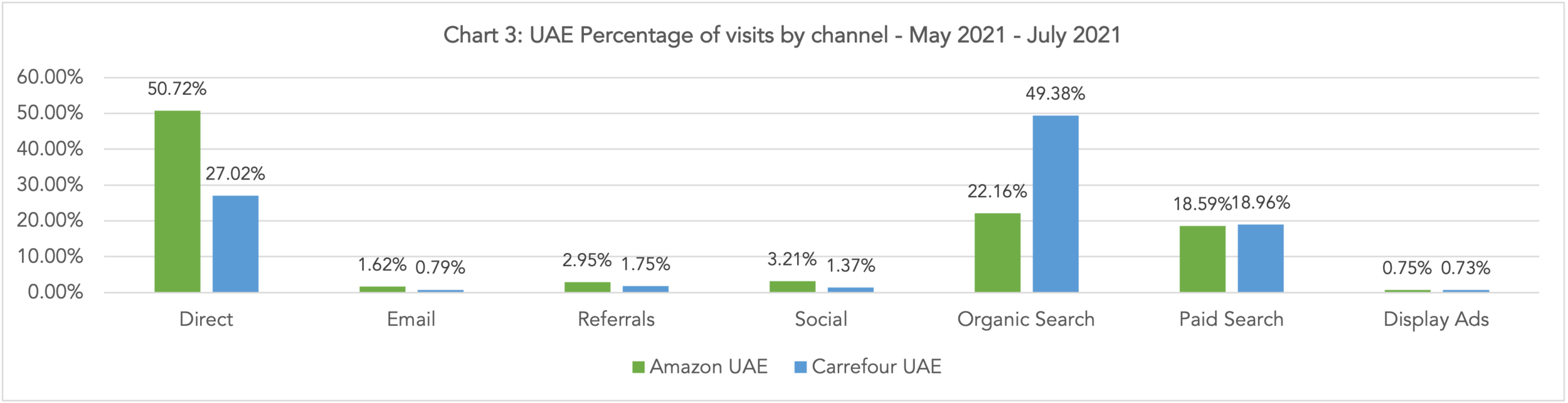

For the UAE market, chart 3 details the percentage of visits by channel for Amazon and Carrefour.

Analysing retailers from both Ecommerce developed and developing markets, we find some commonalities in how consumers find their way to online retailers.

· More than 75% of the consumers arrive at online retailers through a combination of direct visit and organic search. (An experiment conducted by Groupon by deindexing its platform on search engines showed up to 60% of “direct traffic” is organic search)

· After direct and organic search, paid search is the most preferred consumer channel to visit online retailers.

· Referrals from other websites (e.g., a visit to a retailer from manufacturer’s brand website product page) comes after paid search.

· Social media, Email and Display are the least preferred channels to visit online retailers – with display being the worst.

Search (research) playing a greater role in Ecommerce, also relates to a study by Laura Aragoncillo and Carlos. From the insights shared in the study, we understand that purchases in online channels are more planned than offline channels. Moreover, the search dominant consumer behaviour doesn’t stop after arriving at online retailers. For example, with 90% of Amazon’s product page views coming from company’s internal search, Amazon has surpassed Google for product related searches and holds 54% share of the online product search market.

Building on our analysis, below are some recommendations when planning to invest in performance media:

· Take control of performance marketing media planning, use real-time path-to-purchase and path-to-basket data to build the plan and engage publishers to execute it.

· As a retailer, prepare your product pages SEO friendly including imagery, reviews, description, and videos.

· Pay extra attention to eStore tagging and search results optimisation – invest the ad dollars in sponsoring eStore search wherever possible.

· When looking at maximising footfall using off-site media, prioritise paid search above all.

· If you are a manufacturer, build your website product pages Ecommerce SEO Optimised, whilst integrating buying options via APIs in partnership with your key retailers to increase referral visits.

3. Measuring performance marketing:

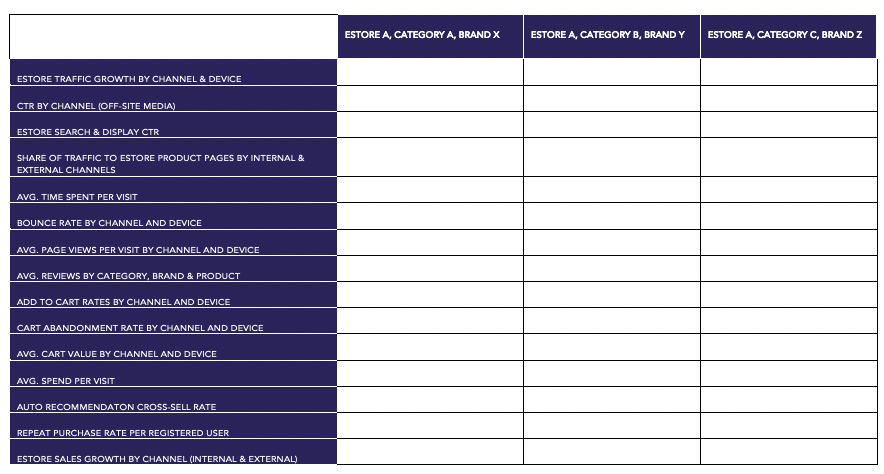

There are more than ‘51 Performance Metrics’ available to measure across different digital advertising formats. Naturally, it could be quite overwhelming to measure and optimise all of them. Therefore, to simplify performance measurement and optimisation process, let’s understand the job performance marketing needs to do for our brands and businesses.

At its core, performance marketing exists to identify a targeted group of consumers and encourage them to generate a response to help sell, cross-sell and up-sell more products. Whether you are a retailer or a manufacturer, investment in performance marketing should help improve three core business KPIs:

· Increase market share.

· Increase online business share vs. offline.

· Increase Return On Marketing Investment (a detailed guide on calculating ROMI can be found here).

In my experience, the below metrics have turned out to be very useful when measuring and optimising performance marketing against the above KPIs.

To conclude:

Between 2017 and 2020, worldwide Ecommerce sales accounted for $12.734 trillion – which is only 12.83% of the total retail sales of $99.2 trillion during the same period. Between 2017 and 2020, global marketers spent $1.2 trillion in online media, compared to $1.278 trillion in offline media. That’s almost half of worldwide ad dollars going into a channel that’s only generating 12.83% of the total retail sales (2017 – 2020 avg.). Triggered by the pandemic led consumer shift to online retail, the future growth of Ecommerce looks promising – however, we have a need to sharpen up our marketing approach to Ecommerce to help increase its share of total retail sales. In doing so, performance marketing has a role to play for both retailers and manufactures.

First, we need to consider performance marketing more than a trend and structure it in a disciplined manner. Like production, sales, supply, warehousing, inventory management, IT, fulfilment – performance marketing is a core element of Ecommerce value chain. Businesses need to build it as a strategic capability and invest across people, processes, and systems to gain competitive edge. For both manufacturers and retailers, performance marketing offers two-fold opportunities; on the one hand, it can help optimise inventory in ways that lead to more consumers, buying more products, more often – on the other, it can assist in building new relationships between manufacturers and retailers through bespoke performance partnerships.

Secondly, using real-time path-to-retailer and path-to-basket data, we need to take over the planning of performance marketing ad dollars. The entire digital ecosystem is designed around growing the dollars for the publishers, not for the advertisers – we need to be mindful of this reality. Whether you’re a retailer or manufacturer, performance marketing investment should help generate bottom-line impact – and it should do that in real-time, as a direct result of your investment.

Thirdly, we need to bring measurement and optimisation of performance marketing next to business KPIs. While it’s easy to feel overwhelmed with all the digital metrics thrown our way – our focus should be to prioritise the ones that help increase market share, online business share and Return on Marketing Investment (ROMI).

This is only the start and as we go along in our performance marketing journey there would be quite a lot to do. Today’s challenges from the internal and external stakeholder complexities, publishers, technology disintegrations, digital data gatekeepers and new consumer behaviours are not altogether easy for the marketers. However, if we can come together to sharpen up in these three areas, then in a future not so distant I feel we will be able to look back with a definite sense of appreciation.